Articles

Navigating Retail Disruption: The Strategies That Will Help Stores Thrive in an Omnichannel World

See examples of how retail disruption is motivating retailers to bridge online and physical shopping channels, improve efficiency, and add new revenue streams.

New technologies and fast-evolving customer demands are disrupting the way brick-and-mortar stores have long operated. So how are retailers responding?

In the following, we’ll analyze the major forces upending conventional retail and then describe key initiatives that retailers are rolling out to adapt. According to retail consultant Jack O’Leary from Flywheel Digital, these initiatives are important to understand because they will likely “create the future retail landscape.”

E-Commerce: The Dominant Disruptor

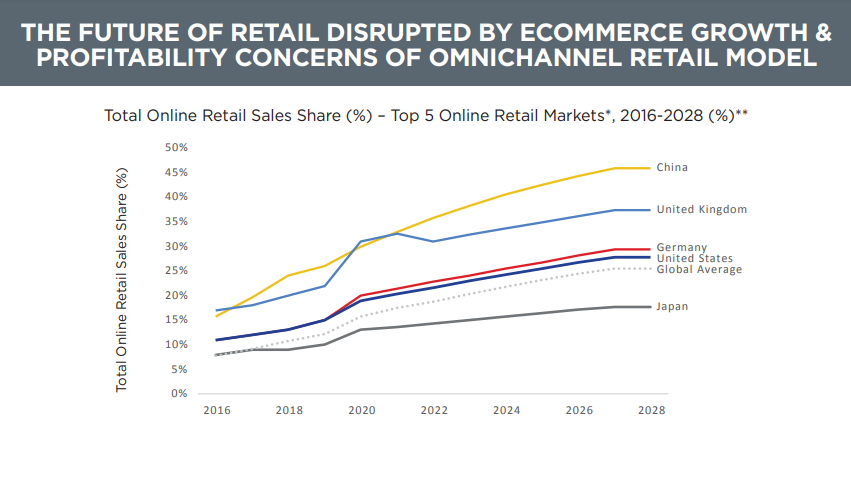

Hands down, the top disrupting force in retail has been the rapid growth of e-commerce. As recently as 2016, e-commerce penetration rates for developed markets like the US and UK were as low as 15% or 16%.

Today, however, O’Leary and the Flywheel team predict that this rate will rise as high as 25 to 30%, or even higher for 2030 and beyond.

As for how stores are responding to the ascendance of e-commerce, O’Leary says, “Retailers see this, they acknowledge it, and they know they have to adapt their business models to become more omnichannel to service this demand.”

A Response That Brings Its Own Challenges

Omnichannel retail integrates multiple shopping channels, both physical and digital, so that consumers can engage with a brand across various touchpoints. Ideally, this approach seamlessly uses in-store, mobile app, social media, and e-commerce strategies.

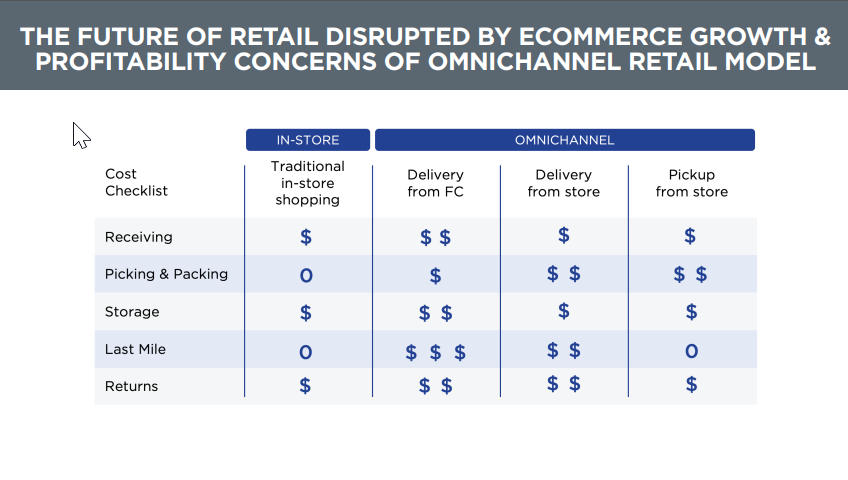

However, the omnichannel approach and its expanded delivery options, in particular, also create “profitability concerns,” as O’Leary calls them. Pick-up at stores, delivery from stores, delivery from fulfillment centers – these come with added costs from:

- Additional receiving

- Picking and packing

- Storage

- Last-mile fulfillment

- Returns

Retailers Aim to Improve Omnichannel Efficiency and Effectiveness

Rather than shying away from omnichannel initiatives, retailers are confronting the potential profitability constraints by adopting new technologies.

O’Leary points to four key areas where retailers are investing to create “omnichannel connectivity like the shopper demands” – and to do so profitably. Let’s take a look.

1. The Store of the Future Will Drive Efficiency with AI and Automation

Retailers are increasingly using AI and automation technology to reinvent the in-store shopping experience. In the process, they hope to create a better customer experience and improve operational efficiency.

As an example, O’Leary points to Sam’s Club and its recent investment in AI-powered checkout technology, which analyzes cart items against the customer’s receipt. Sam’s Club has reported the tech helps shoppers leave stores 23% faster. The club store retailer rolled out the technology in 120 locations in 2024.

2. E-Commerce and Digital Ecosystems Will Transform Stores into Online Assets

More and more retailers are reimagining the physical store as an asset to boost the efficiency of online-based sales. Walmart, for instance, recently announced that quarterly e-commerce sales worldwide rose 21%, pointing to store-fulfilled pickup and delivery as major reasons for the increase.

But the in-store shopper is also creating an opportunity for retailers to generate advertising revenue. Take again Walmart as an example. The retailer reported a 30% rise in sales from its advertising arm, Walmart Connect.

O’Leary says this strategy deserves a closer look as Walmart seeks to expand its retail media efforts with in-store digital advertising.

The retailer has installed more than 170,000 media screens across its network of 4,500+ stores in the US alone. And considering its reach, that’s hardly a minor point, with 90% of Americans living within 10 miles of a Walmart.

3. Retailers Will Deliver More In-Store Digital Experiences to Engage Customers

With more of today’s shoppers motivated by digital content, especially social media, retailers such as UK-based Asda are trying to bring this phenomenon directly into their stores.

Asda has created in-store digital displays featuring TikTok influencers and Unilever cleaning products. These “cleanfluencers” appear on video while shoppers have the opportunity to see – and select – product recommendations from adjacent store shelves.

4. Retailers Will Innovate Their Supply Chains to Improve Fulfillment

With omnichannel shopping comes the need for retailers to fulfill orders in potentially multiple ways. As noted above, this new model brings substantial costs, particularly for inventory-heavy sectors like grocery. In response, retailers are trying new fulfillment strategies to reduce those added costs.

For instance, US-based regional grocer Giant Eagle recently made headlines by investing in its first micro-fulfillment center (MFC). Typically connected to, or at least physically near, a retail store, an MFC enables a retailer to stock a variety of grocery items for faster picking and packing, often via robotic systems.

“This is Giant Eagle outlaying capital today to set up a system that will make them more efficient and profitable in the future and more omnichannel-enabled for the shopper,” explains O’Leary.

New fulfillment strategies also include expanding partnerships with third parties. Albertsons, for example, has expanded its partnership with Instacart. This enables the grocery giant and its numerous banners to offer home delivery and in-store pickup through Instacart’s app-based platform.

Key Takeaways: Disruption Will Foster a More Connected Retail Ecosystem

How retailers respond to the disruption today – which is driven primarily by e-commerce – will have a profound effect on retail’s evolution. Let’s recap the key takeaways from O’Leary and the Flywheel Digital team:

- More and more stores will implement AI and automation to improve operational efficiencies and customer satisfaction.

- Advances in micro-fulfillment centers and expanded partnerships with “last-milers” like Instacart will fuel omnichannel supply chain and fulfillment initiatives.

- Retailers will complement e-commerce advertising with high-margin verticals such as in-store digital advertising to offset the costs of providing omnichannel retail.

- More innovations will emerge that encourage shopper engagement and retention by connecting online channels with the in-store experience.

Learn more about how these retail solutions can work for you.