Articles

Convenience Store Industry Analysis: What C-Stores Are Doing to Excel in the Grocery Sector

A convenience store industry analysis. Understand why this small-format retail channel has such a bright future.

The convenience store channel is soaring. Below, learn how more and more convenience stores (or C-stores) are taking inherent benefits like accessibility and quick transactions to another level. Plus, get details on the features they’re adding to meet the needs of today’s more digitally oriented shopper.

Let’s dive into a C-store industry analysis, including intriguing benchmarking data, with retail consultant Jack O’Leary, Head of Advisory, North America, for Edge by Ascential.

Defining the C-Store

To clarify just what types of stores comprise the C-store channel, O’Leary categorizes the industry into the following:

Gas station C-stores. Adjacent to the fuel pumps, these stores often operate as joint ventures between oil companies and retailers.

Pure convenience stores. These non-fuel, small-format stores are proximity-oriented and offer a limited range of groceries and essential goods. They’re often operated by large-scale retailers that use a franchise model.

Traditional, independent C-stores. These owner-operated, mom-and-pop formats (sometimes known as bodegas or corner stores) are prevalent enough to be a significant part of the industry.

C-Store Channel Growth: A Stand-Out in the Grocery Sector

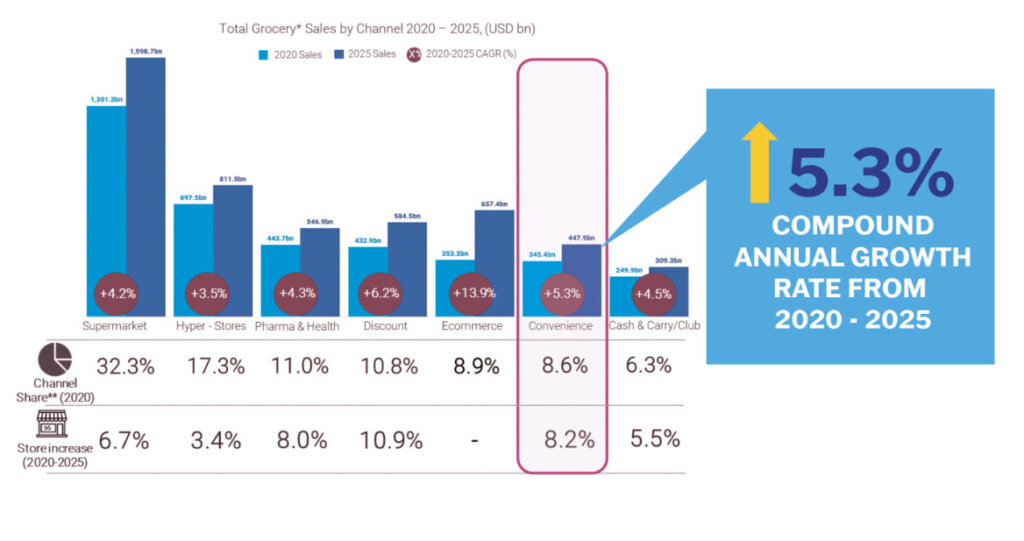

Based on Edge by Ascential’s analysis, O’Leary reports C-store channel earnings of more than $345 billion worldwide in 2020, with projected sales at $448 billion by 2025, constituting a 5.3% compound annual growth rate (CAGR) for that period (see chart below).

And that’s a statistic worth underscoring. According to O’Leary, “That is the fastest store-based growth rate we have in our Edge database in terms of sales.”

For some perspective, consider that the supermarket channel has a CAGR of 4.2% over that same time period.

Strategic Transformations to the C-Store Sector

So what are the initiatives that C-store retailers are making to transform store features and shopper options? O’Leary singles out four areas in particular.

1. Amping Up Fulfillment Capabilities

Major C-store chains are keeping pace with the ever-increasing fulfillment expectations of consumers.

Edge by Ascential’s benchmarking specifically on fulfillment in the C-store channel involved scoring operators around the world on factors like fulfillment speeds, geographic coverage, and delivery partnerships.

Not surprisingly, as the table above illustrates, big names like 7-Eleven and Circle K top the list. “They’re some of the largest operators around the world, and they can invest more heavily in these capabilities,” says O’Leary.

Additional findings include the following:

- More than one-third of the convenience stores studied offer click and collect, where the shopper buys online and picks up at a store.

- 90% of those stores offer home delivery.

- 73% of the stores offering home delivery have partnerships with intermediaries like Instacart or DoorDash.

2. Adding Automation

Increasingly sophisticated automation has emerged in the C-store channel, leading to capabilities that are transforming both the checkout process and store operations.

O’Leary says the automation factor is important not only for customer convenience but also to drive profitability in the face of rising labor costs. Check out these examples:

Cashier-less stores. France-based Monoprix’s Black Box (see image above), for example, has launched an unmanned store concept that uses a sophisticated shelf-weighing system. Shoppers enter via a credit or bank card, choose items, and walk out – all with no employee needed.

Robotics. Japan-based FamilyMart is deploying robotics in their stores to stack drinks, sandwiches, and other ready-made meals.

3. Revitalizing In-Store Selection

To meet the evolving tastes of consumers, C-stores are also shaking up – and expanding – their food selections.

7-Eleven, for instance, is making a concerted effort to offer more plant-based food options. (Here’s a helpful video detailing examples of this in 7-Eleven’s Hong Kong market.)

Another example, one that combines automation and meal options, is Carrefour Poland’s in-store vending machines, which provide warm, ready-to-eat dishes.

O’Leary says examples like these demonstrate how the C-store channel is proactively seeking new ways to “drive the consumer into the store environment in a more meaningful way.”

4. Embracing the Digital Movement

Like so many other retailers, those in the C-store channel are integrating digital capabilities through features such as cashier-less stores (see No. 2 above) as well as, for example, curating store selections based on customer-derived purchasing data.

And the growing digital options even extend to purchasing fuel. For instance, now at more than 11,000 Exxon and Mobil gas stations, customers equipped with Amazon’s voice-powered assistant, Alexa, can say, “Alexa, pay for gas.” This initiates a fully digital purchasing process. (See this Car and Driver article for more details.)

The Future of the C-Store Channel

What’s the future of a channel that makes convenience the number one priority? O’Leary breaks it down into the following key areas to watch:

C-stores as ecommerce assets. “The proximity of these locations,” explains O’Leary, “make C-stores an effective anchor point for either delivery or pick up for ecommerce operations.”

Remedies for rising costs. Rising costs, for labor in particular, will be a major factor for continued automation efforts.

Store offerings. Strategically diversifying store item selections will help drive shoppers into these locations, whether they’re filling up at the pump or shopping at the neighborhood C-store in an urban area.

Digital opportunities. “Today’s consumer demands digital experiences at their retail shopping environments, and C-stores are not removed from that reality,” says O’Leary.

If you’d like to discuss ways to improve the retail environment for your customers, contact Marmon Retail Solutions today!