Articles

Retail Media Trends and Examples for Brick-and-Mortar Stores

Get the basics on how retail media works AND learn about the latest retail media trends, including examples from brick-and-mortar stores.

Reaching customers through effective advertising is hardly a new concept. But what if you could reach them digitally to both increase sales AND improve the in-store shopping experience? That’s the potential that retail media holds for brick-and-mortar retailers.

In the following, we’ll help you understand what retail media is, how it works, and, more specifically, the various ways it’s emerging within the brick-and-mortar environment. We’ll do that with the help of Jack O’Leary, head of consulting, North America, for the commerce consulting firm Flywheel Digital.

What Is Retail Media?

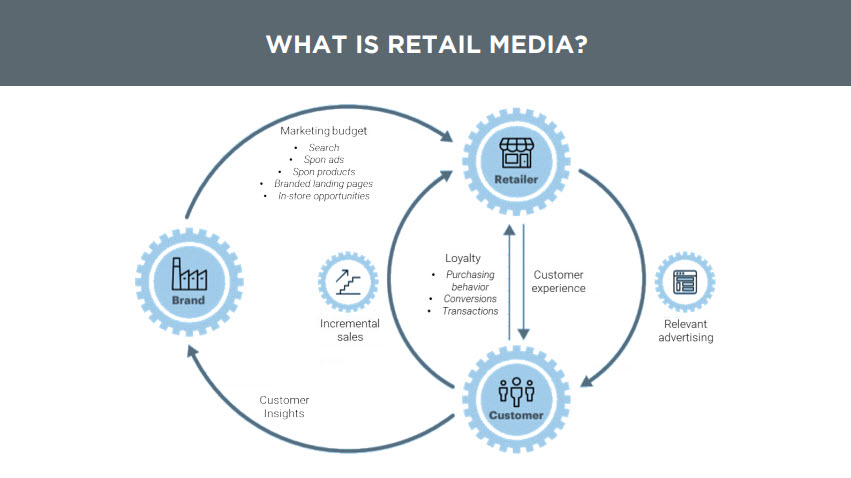

Let’s start with the basics. Retail media is a way for retailers to provide advertising capabilities to brands. According to O’Leary, it’s an example of “retailers looking to monetize the massive amount of … attention they get from serving consumers ads.”

Given the dominance of the digital landscape today, retail media has primarily involved ads presented on e-commerce platforms. However, using retail media as an in-store strategy is becoming increasingly important for brick-and-mortar retailers.

They can serve up relevant advertising to customers based on their loyalty and, more importantly, on the data the retailer has about them. The ultimate goal for the brick-and-mortar retailer is to “enhance the customer experience and sell more products to the consumer,” says O’Leary.

The Business Model for Retail Media

So how does retail media actually work? Retailers look to their branded supplier partners—the companies selling the products in their stores—as the key marketers for using retail media platforms, whether online or in stores.

As these brands seek to capitalize on a given retailer’s retail media reach, they’re spending what are often sizable marketing budgets on:

- Search

- Sponsored ads

- Sponsored products

- Branded landing pages

- In-store opportunities

In the process, brands are looking to leverage the unique data and customer insights the retailer has about consumers—valuable info that isn’t necessarily available with other advertising methods.

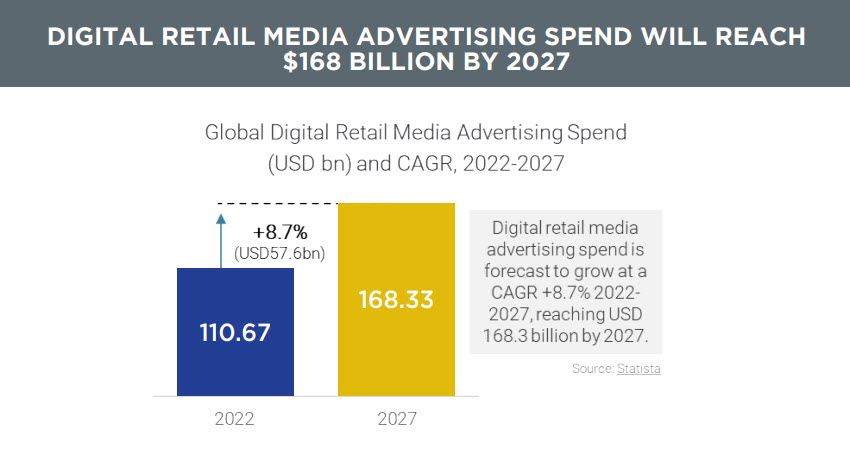

Retail Media Spending Will Grow at an 8.7% CAGR

Based on global research conducted by Flywheel Digital, spending for digital retail media advertising is expected to grow at an 8.7% compound annual growth rate (CAGR) from 2022 to 2027, reaching over $168 billion worldwide by 2027.

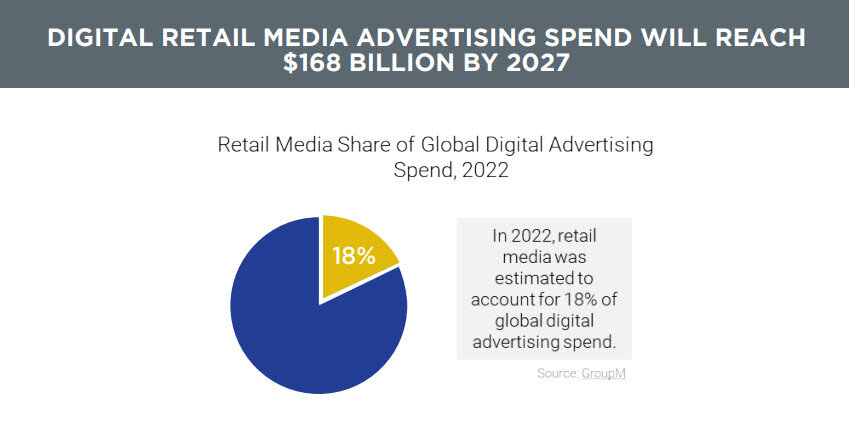

In fact, O’Leary says that even as of 2022, retail media was already an estimated 18% of global digital advertising spend, “taking substantial share away from traditional search or social media digital advertising.”

Channels Vary But Top Retailers Across Channels Are All-In

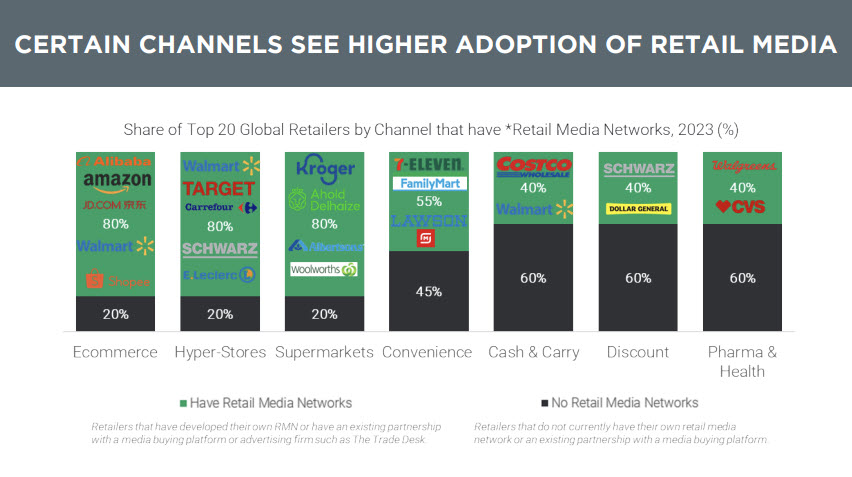

Adoption rates for retail media networks vary significantly by channel. Here are the results of Flywheel Digital’s benchmarking studies on the top 20 global retailers in each of seven retail channels:

- E-commerce: 80%

- Hyper-stores: 80%

- Supermarkets: 80%

- Convenience: 55%

- Cash & Carry: 40%

- Discount: 40%

- Pharma & Health: 40%

Regardless of the variation, O’Leary points out that across channels, “the largest players, the ones with the biggest customer network and shopper base, tend to have a retail media business that they’re looking to stand up.”

The “Most Valuable” Shoppers Behind the Rise of Retail Media

The push behind retail media comes largely from the growing importance of the omnichannel shopper, a consumer who moves fluidly between online and offline shopping.

O’Leary explains that this type of shopper is the most likely to be served retail media ads and, therefore, is “the most valuable shopper to the retailer and then also to their advertising partners.”

Consider the following data on this increasingly crucial shopper category:

- 87% of shoppers begin product searches on digital channels even if they purchase in store

- 1 in 3 in-store purchases start online

- 71% of shoppers use mobile devices in store for product research

Moreover, omnichannel shoppers can mean higher sales volumes. For instance, compared to its online-only shoppers, Target reports that its omnichannel shoppers spend four times as much.

Similarly, France-based Carrefour says that over a 24-month period, the spend per customer for omnichannel shoppers was 27% higher than offline-only shoppers.

In-Store Retail Media: Real-World Examples

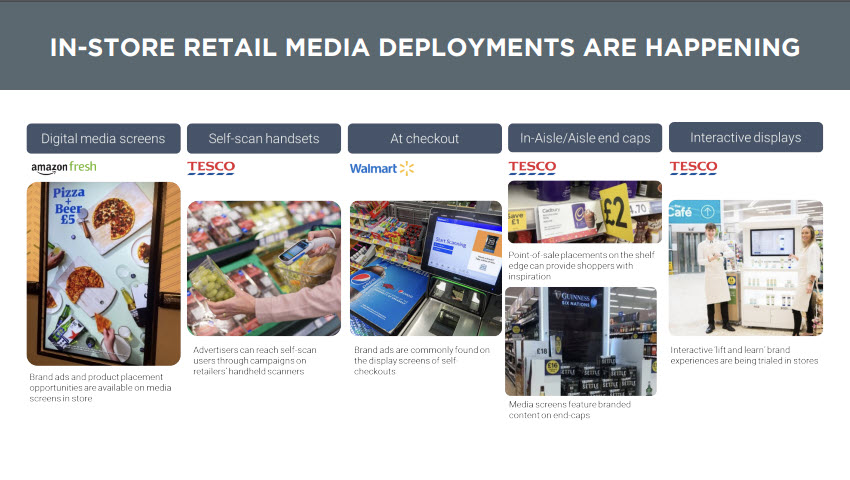

When we turn specifically to how retail media extends to the brick-and-mortar environment, O’Leary says you can expect to see a range of applications:

- Digital media screens

- Self-scan handsets

- At checkout

- In-aisle/aisle end caps

- Interactive displays

Examples of screen-based retail media include the following from some big names in retail. As O’Leary points out, in some cases the interplay of physical merchandising with digital technology will likely play a crucial role in the application’s ultimate effectiveness.

Kroger has extended its digital smart screen rollout to 500 stores across the US. These smart screens sit on cooler fronts and can display retail media to consumers that are walking by.

Tesco has adopted smart screens at the entrances of more than 500 stores and plans to roll out more over the coming year.

Retail media installations are also leading to store lay-out changes. Walmart, for instance, has redesigned many of its stores to include a variety of in-aisle digital screens for presenting ads.

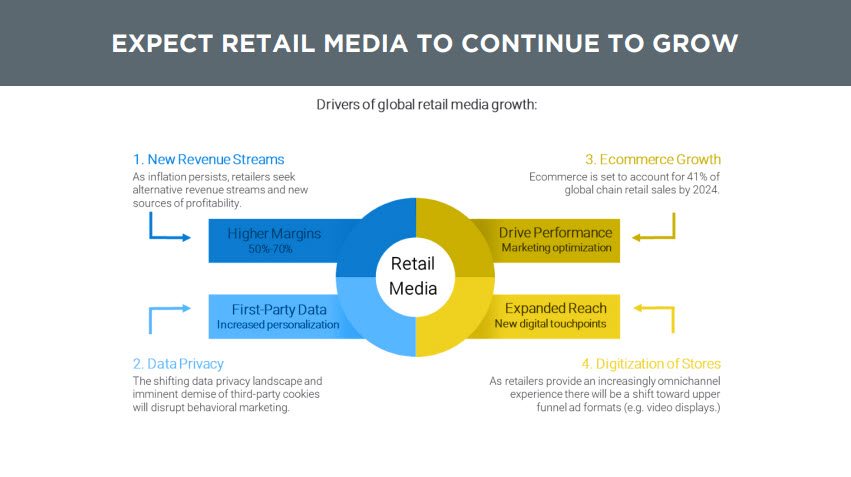

Future Retail Media Growth: Tailwinds and Headwinds

As we look to the future, what will likely drive retail media’s growth?

New revenue streams. O’Leary says, “Retailers are seeking new profitable revenue streams—and retail media is that. It has more profitable margin dynamics than typical retailing.”

E-commerce. Retail media ads effectively serve, in particular, e-commerce and omnichannel shoppers. “And so with more e-commerce growth and more digital shoppers,” says O’Leary, “this advantages the retail media platform and makes it better for advertisers and retailers.”

On the other hand, the rise of retail media also brings new challenges and concerns:

First-party data control. Acquiring shopper data is what powers the success of retail media platforms. But that also means retailers will have to navigate the complexities around data privacy laws and data utilization.

Digitally activated shoppers. Closely related to the above point, effective in-store retail media depends upon shoppers being digitally activated. O’Leary explains, “You have to have more activated shoppers—either on their mobile phones or walking by in-store screens—identifying themselves via things like retail loyalty programs.”

Finally, for all of the factors above, O’Leary says they’re important to watch because they serve as “the signs of whether in-store retail media grows or stagnates.”

Learn more about how these retail solutions can work for you.